UK Automotive Market Set to Rebound Strongly Amid Post-BREXIT Challenges and Green Transition Goals

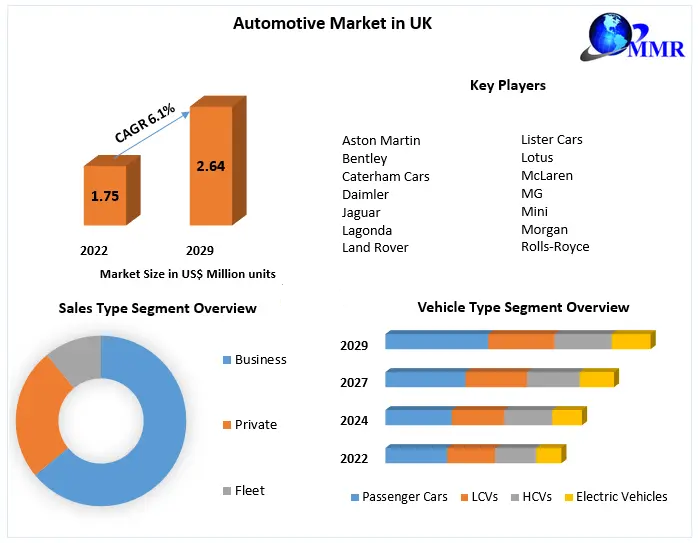

The UK Automotive Market, accounted at 1.75 million units in 2022, is poised for a robust recovery and transformation. With a projected CAGR of 6.1% over the forecast period from 2023 to 2029, the market is expected to reach 2.64 million units by the end of the decade. Despite a tumultuous period marked by COVID-19 disruptions and BREXIT aftershocks, the industry is actively adapting, driven by innovation, government policy shifts, and a rising demand for electric and hybrid vehicles.

Gain Valuable Market Insights by Exploring the Sample Report:https://www.maximizemarketresearch.com/request-sample/86645/

Industry Overview: Rebuilding Through Resilience

The UK automotive industry is navigating one of the most complex periods in its history. As the nation recalibrates from the effects of BREXIT and pandemic-induced supply chain disruptions, manufacturers and suppliers are facing heightened challenges. A core issue remains the sector's over-reliance on non-UK supply chains, a vulnerability made glaringly evident during global lockdowns.

Consumer confidence, shaken by uncertainty, has dampened new vehicle sales. In response, the market is witnessing a surge in digital-first dealerships and virtual purchasing platforms. This transformation is expected to redefine how vehicles are marketed and sold in the coming years.

Market Dynamics: Green Mandates Drive the Future

The UK government's ambitious Net Zero targets are reshaping the market landscape. The planned phase-out of new internal combustion engine (ICE) vehicles by 2030 underscores the urgency for automotive stakeholders to embrace zero-emission alternatives. With the UK already home to a skilled automotive workforce, this shift could potentially decentralize employment opportunities across the nation, reducing economic disparities between regions.

However, the gap between ambition and investment remains a concern. The UK lags behind other major economies in EV battery manufacturing capabilities. Projections show the UK will reach only 12 GWh of lithium-ion battery capacity by 2025, significantly lower than Germany’s 164 GWh or the USA’s 91 GWh. Bridging this gap will be vital for the UK to retain its global manufacturing competitiveness.

Economic Impact: A Vital Contributor to National GDP

The automotive industry contributes £15 billion in GVA to the UK economy and plays a crucial role in narrowing regional disparities. Over 80% of vehicles and 60% of commercial vehicles manufactured domestically are exported to over 150 countries. The EU remains the UK's most vital market despite a 2.5% decline in export volumes. North America and Asia also serve as key destinations, though rising Asian demand, especially in China and South Korea, may help offset the loss from companies like Honda reducing UK-based operations.

Market Trends: Rebounding After a Decline

In 2016, the UK automotive market peaked with 3.06 million light vehicle units sold, only to decline steadily following the BREXIT referendum. Registrations dipped to 1.63 million units in 2020, marking a 29.4% YoY drop due to the pandemic. In 2021, although Q2 saw a rebound of 185.1% owing to previous year lows, total annual sales reached only 1.65 million—a modest 1% rise from the prior year.

Competitive Landscape (2021):

Brand dynamics in 2021 showcased notable shifts. Volkswagen maintained its lead despite a marginal dip, while Audi and BMW strengthened their positions. Ford, once the market leader, experienced a significant 23.9% decline. Korean brands like Hyundai and Kia saw remarkable growth, with Hyundai’s sales soaring by 46.7%. Tesla’s Model 3 surged into the top two, reflecting increasing EV demand, while traditional favorites like the Ford Focus and Opel Corsa saw double-digit declines.

Top 10 Brands (2021 Performance Highlights):

-

Hyundai: +46.7% (Top riser)

-

Kia: +28.7%

-

Tesla Model 3: +58.2% (Second most sold vehicle)

-

Ford: -23.9%

-

Opel Corsa: Most sold with 40,914 units (-14.2%)

Segment Analysis: Passenger Cars Dominate

By Vehicle Type:

-

Passenger Cars lead with a 60% market share, bolstered by strong sales from brands like Volkswagen and Ford.

-

Electric Vehicles (EVs) and hybrids are rapidly gaining ground, representing over a third of UK automotive production in November 2021 alone.

-

Battery EV production surged 53% YoY in November 2021, led by domestic plants from Nissan, MINI, and the London Electric Vehicle Company.

By Sales Type:

-

Fleet Sales dominate with a 53.3% share, driven by corporate leasing and demonstrator vehicles.

-

Private Sales account for 44.1%, while Business Sales represent just 2.6%, indicating limited commercial registration growth.

Gain Valuable Market Insights by Exploring the Sample Report:https://www.maximizemarketresearch.com/request-sample/86645/

Key Challenges & Opportunities

Challenges:

-

Delayed investment in battery infrastructure and gigafactories

-

Uncertain post-BREXIT trade regulations

-

Declining export volumes, especially to the EU and North America

Opportunities:

-

Government policies promoting Net Zero and EV transition

-

Rapid digitization of car buying experiences

-

Growing demand in emerging markets such as South Korea and China

Leading Players in the UK Automotive Market

The UK automotive landscape is home to a diverse set of manufacturers, from high-end luxury brands to electric vehicle pioneers:

-

Aston Martin

-

Bentley

-

Caterham Cars

-

Daimler

-

Jaguar

-

Lagonda

-

Land Rover

-

Lister Cars

-

Lotus

-

McLaren

-

MG

-

Mini

-

Morgan

-

Rolls-Royce

Conclusion: A Transforming Industry with Resilient Foundations

The UK Automotive Market stands at a crucial crossroads—balancing economic recovery, environmental responsibilities, and global competitiveness. As the industry pivots toward EVs and digital innovations, the groundwork laid today will determine its position in the next decade.

With strategic government investment in battery production, charging infrastructure, and sustainable energy, coupled with resilient domestic manufacturing and skilled labor, the UK has the potential to reassert itself as a global automotive powerhouse.

For investors, stakeholders, and industry professionals, the next five years present a unique window to capitalize on the UK automotive sector’s green and digital transformation.

Comments on “Automotive Market in UK Experiences Growth in Online Car Sales Platforms 2029”